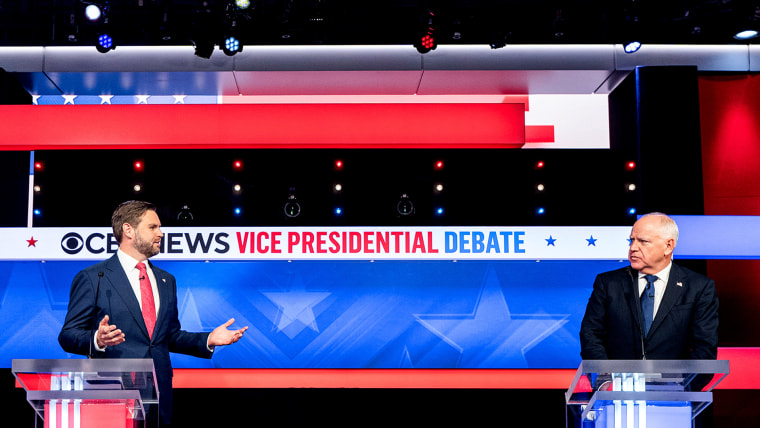

Sen. JD Vance of Ohio, the Republican nominee for vice president, doubled down on his proposal to put people with pre-existing conditions in a “high-risk pool” and keep them apart from healthier people during Tuesday night’s vice presidential debate. He also pledged to protect health insurance coverage for those with pre-existing conditions.

The two claims, which harked back to a period before the Affordable Care Act, which guaranteed care for those with pre-existing illnesses, became law, seemed incompatible to many policy experts watching the argument.

Arthur Caplan, the director of medical ethics at NYU Langone Medical Center in New York City, stated, “We tried that in the past and it failed.” “Any attempt to isolate pre-existing conditions is bound for complete failure.”

Cynthia Cox, vice president and head of the ACA program at KFF, a nonprofit organization that studies health policy problems, stated that prior to the ACA’s adoption in 2010, the majority of states depended on high-risk pools to offer coverage for those with chronic conditions.

People in the “gray zone,” who did not have diabetes or cancer but “their kid had three ear infections in the last year and insurance could charge them a higher premium,” were also placed in high-risk pools, according to Cox.

Even while they make up only 5% of the population, the sickest patients in the country—those with chronic diseases like cancer, for example—account for more than half of all health care spending, according to Cox. People with chronic illnesses were frequently considered “uninsurable” by insurers due to the high premiums, she claimed, and they would not be granted coverage.

Cox stated, “You just couldn’t get insurance anywhere because you had such a high cost condition.”

A high-risk pool was intended to act as a safety net for those who were having trouble obtaining insurance because of pre-existing medical issues. By removing some of the financial risk, the pools—which brought together individuals with chronic illnesses—encouraged insurers to provide coverage. This was frequently accomplished through a mix of state money, federal subsidies, and requirements. Additionally, this kept ill patients’ monthly premiums cheaper.

However, the underfunding of the high-risk pools resulted in monthly premiums for certain patients that were twice as costly as those of a healthy individual, according to Cox. Insurers would also decline to pay for patient care due to a shortage of funds.

According to Cox, “you might have had an exclusion on your coverage for six to twelve months if you got into a high-risk pool.” “Therefore, after entering the high-risk pool, you might not be able to receive any chemotherapy for six months or a year if you had just received a cancer diagnosis, for example.”

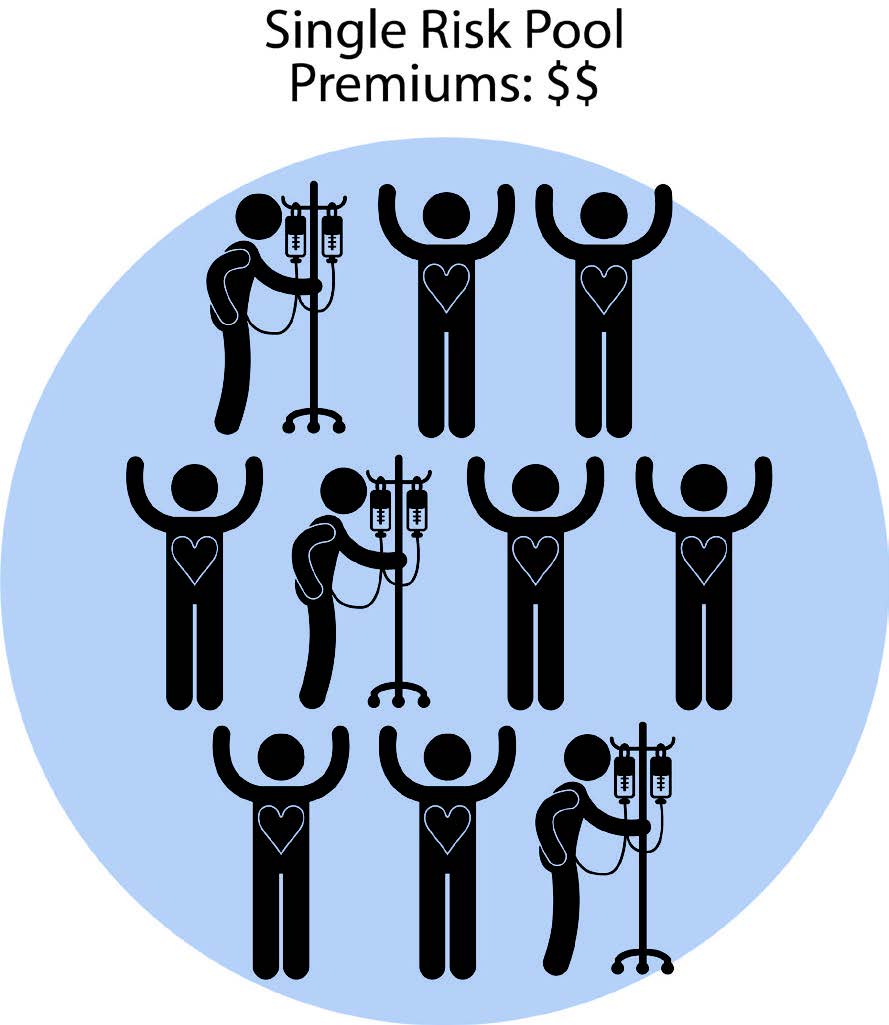

The Affordable Care Act (ACA) made an effort to solve this issue by doing away with high-risk pools in favor of a single-risk pool model, which would allow younger, healthier persons to somewhat balance the costs associated with older people who usually have more chronic problems.

John A. Graves, a professor of health policy and medicine at Nashville, Tennessee’s Vanderbilt University School of Medicine, described the basic concept as “sort of a social contract.” “You pay those same monthly premiums when you’re young and healthy, but that market will support you later in life if you get sick or have higher costs.”

During the discussion, Minnesota Governor Tim Walz, the Democratic contender for vice president, expressed a similar viewpoint.

The only way insurance functions, in my opinion, is to ensure that the risk pool is large enough to include everyone, according to Walz. “It collapses when it doesn’t.”

According to Graves, returning to a high-risk pool model in the United States would need “a massive amount of government subsidies to work.”

He stated, “They would basically have to inject enough subsidies into the high-risk pool to keep premiums affordable for people.” “If they don’t, you’re effectively increasing premiums on sick individuals.”

Cox wasn’t sure what would be gained by switching back to a high-risk approach, particularly if more funding from the federal government was needed to keep the program running.

Even still, according to Caplan, it wouldn’t work.

“To make it affordable, you have to share the risk widely, among a large group,” Caplan stated. “For the previous 25 years, we have used isolated pre-existing pools, but they are ineffective.”