As part of a larger move from public to private markets, wealth managers claim that their customers have been cutting back on their stock ownership for more than a year.

Prior to last week’s market fluctuations, wealthy investors and family offices avoided equities, but many viewed the price decline as a chance for tax savings and estate planning, according to wealth experts.

In light of recent worries about an overheated tech sector, private banks and wealth managers claim that their customers have been cutting back on their stock holdings for more than a year as part of a larger move from public to private markets.

A UBS survey of family offices found that while stocks make up just 28% of their portfolios, private equity makes up the highest portion, at 35%, for family offices.

According to a Deloitte poll, family offices’ private equity increased from 22% in 2021 to 30% in 2023, although their equity holdings decreased from 34% to 25% between 2021 and 2023.

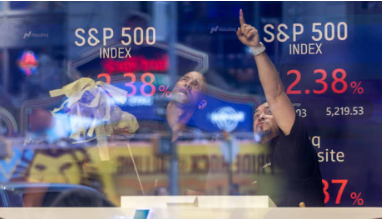

Rich investors did not panic or rush to purchase when equities fell on Monday, with the S&P 500 and Nasdaq down 3%, according to a number of experts. Indeed, they were rather inquisitive.

Sean Apgar, a partner and co-head of portfolio and wealth advising at BBR Partners, which provides advice to extremely affluent customers, stated that “the common question from clients was ‘What’s going on?'” “There wasn’t really a reason for action; it was more out of curiosity.”

According to Apgar, given their lengthy investment horizons, the customers BBR advises, the majority of whom are worth hundreds of millions or billions, don’t respond to short-term market occurrences. But they did want to know about the market movements, the carry trade with Japan, the mounting concerns about the recession, and the likelihood of rate cuts. Their investment plan remains their investment plan for his clientele.

“Assuming expected volatility and corrections along the way, the best thing clients can do at this time is sit back and feel good about the investment plan we put in place with them long ago,” stated Apgar.

The price reduction that occurred on Friday and Monday presented an opportunity for affluent investors to use gifting and tax advantages.

According to William Sinclair, chairman of J.P. Morgan Private Bank’s financial institutions business and U.S. family office practice, an increasing percentage of clients have “separately managed accounts,” which are discrete accounts intended to keep a certain set of equities or assets. Clients can more readily engage in “tax-loss harvesting,” or selling stocks that have lost value and realizing losses that can be applied to offset capital gains from winning equities, if they have separate accounts.

Due to the 15%+ decline in several Big Tech stocks over the last month, affluent individuals are selling their equities at a loss, taking advantage of the tax benefits, and then repurchasing the stock to maintain their position.

“The largest inflows for taxable clients have been in tax loss harvesting strategies,” according to Sinclair.

Some are planning their estates with the price fluctuations. Married couples can give up to $27.22 million to heirs and relatives under the existing estate and gift tax regulations, while individuals can give up to $13.61 million. Rich investors are trying to give away as much as they can before the gift and estate exemption amount expires at the end of the next year.

Giving equities that have lost value has more advantages since it permits investors to give out more shares within the exemption limit.

According to Apgar, “you can transfer that lower value to the next generation, assuming the assets will eventually appreciate again, say you have a stock that was worth $100 and it’s now worth $80.” It appears that you are exploiting the low values. These circumstances typically excite tax advisers because they provide fresh opportunities.

Corporate founders and senior executives are among the clientele that is particularly vulnerable to the current waves of volatility. Advisors can assist them in setting up sophisticated hedges, such as variable prepayment forwards and exchange funds, to help lessen the impact of significant stock drops, as they frequently have a sizable amount of their wealth invested in a single company’s shares. For many founders and CEOs, the advantages of so-called “collaring” structures were brought to light by the previous week’s market slide.

“People in these roles, in the C-suite, understand that their work and career will revolve around the stock,” said Jennifer Povlitz, division director of UBS Wealth Management U.S., a firm that provides financial advice to several customers with substantial stock holdings. Thus, the aspect of financial planning needs to be taken into account.

Even while the S&P 500 is only up around 10% this year, it gained 24% in 2023. Nevertheless, family offices and extremely affluent investors are continuing to allocate a larger portion of their funds to alternatives, particularly private equity. Many believe that, in the long run, private businesses are more reliable and profitable than stocks, particularly in the wake of days like Monday. Additionally, they may directly influence management in private enterprises more.

Geoffrey von Kuhn, an advisor to some of the biggest family offices in the country, stated that “most family offices are so invested in alternatives, hedge funds, PE, and real estate that they aren’t moving their investments around anyway.”

According to Richard Weintraub, president of Citi Private Bank’s family office business for the Americas, family offices have been shifting their capital to less volatile, longer-term assets that may increase over several decades or generations. Direct negotiations to purchase shares or control of private firms are a popular trend among family offices, in addition to venture capital and private equity.

According to Weintraub, “the larger family offices—those with $10 billion or more in assets—are investing in businesses that they can own forever and pass down to future generations.” “Akin to constructing the Buffett model.”

The stock market losses over the previous week, he continued, “reinforced the idea of making that shift toward private investments.”

When it comes to private markets and alternatives, high-net-worth investors are still lagging behind family offices, according to Michael Pelzar, head of investments at Bank of America Private Bank.

High-net-worth investors are, in my opinion, underallocated to alternatives overall, according to Pelzar. We see this volatility as a driving force behind the high net worth investors’ continued portfolio diversification. I believe that following this week, there will be a greater willingness to consider different options, whether in real estate or private equity.

According to advisors, geopolitical risks and fiscal spending are the top concerns of high-net-worth investors on the general state of the investing environment. According to Jimmy Chang, CIO of Rockefeller Global Family Office, clients are more likely to inquire about the effects of government debt and deficits than they are about stock market volatility.

He stated, “They want to know the implications for market and economic conditions, as well as tax planning.”