The current worry engulfing the theater business is greater mergers and more issues.

Paramount and Skydance have reached a merger deal after many months of negotiations. The people engaged in the planned union have hailed it as a wonderful fit, but Hollywood’s theater owners have some reservations.

To be more precise, the industry’s ongoing consolidation will make the production problems worse, which have recently resulted in fewer movie releases.

“The National Association of Theatre Owners, or NATO, president and CEO Michael O’Leary stated in a statement on Monday that a merger that affects the number of movies produced will not only hurt consumers and result in less revenue, but will also negatively impact people who work in all sectors of this great industry — creative, distribution, and exhibition.”

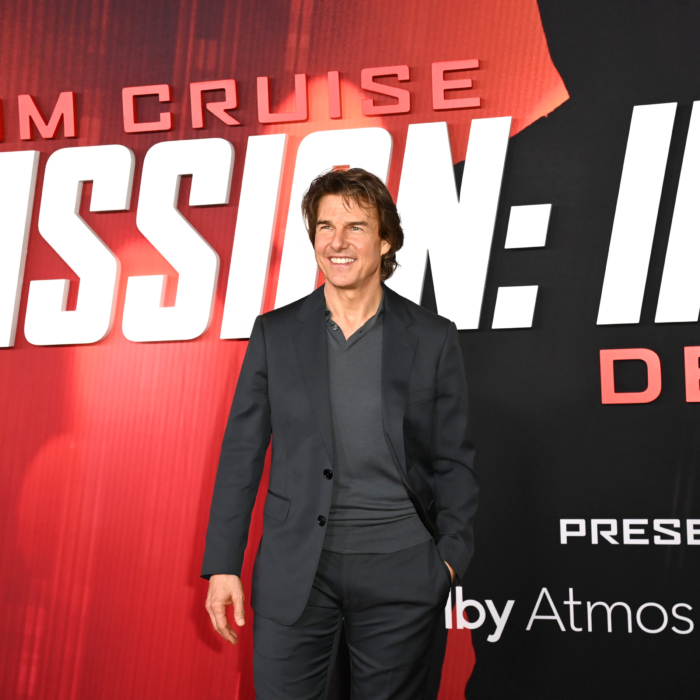

For many years, Paramount and Skydance have collaborated on cinematic projects together, co-financing and releasing movies from the Transformers, Star Trek, Mission: Impossible, and Terminator series, among others.

In a Monday investor call, Skydance founder David Ellison boasted about the thirty feature films that Skydance and Paramount had co-produced. “Unify the key rights to several of Paramount’s most iconic franchises,” he said, adding that the agreement will “allow us to expand franchise management.”

But each firm has other manufacturing partners, so it’s hard to say how this combination would impact future output.

According to Box Office Theory’s creator and CEO Shawn Robbins, “the entire industry will be closely watching how Skydance and Paramount’s release slate evolves in the coming years.” “I believe it’s fair to say that for now, cautious optimism prevails. It isn’t the same as when a different big studio took over and bought Paramount, which most certainly would have greatly reduced the quantity of theatrical entertainment produced. Right now, nothing is definite.

NATO and other organizations have expressed concern over the merger, which follows the 2019 combination of Disney and 20th Century Fox. Data from The Numbers indicates that prior to their merger, each of the two studios was putting out around a dozen games annually. Only around a dozen movies have been released annually by the united company since 2021.

Furthermore, the two companies have only released three games in 2024 so far.

According to Paul Dergarabedian, senior media analyst at Comscore, “theater owners’ concerns over the effect that a diminishing number of films in the marketplace has on their bottom line are the root cause of merger-phobia.” “The key to success at the multiplex is momentum, which is ensured by a robust pipeline of big screen offerings that keeps the industry humming along.”

Paramount Presently displaying

The sluggish inflow of new titles has been problematic for the theater business as a whole. Production was severely hampered by pandemic shutdowns, which were followed by a joint Hollywood strike that further hampered the release schedule. Box office experts anticipate a rise in the quantity of films in 2025 and 2026, but it’s unclear whether output will ever reach pre-pandemic levels again.

“Yet, even though the industry is volume-driven, what matters more than quantity is the caliber of the releases and how well they resonate with audiences,” Dergarabedian said. It’s not inherently a negative thing if there are fewer movies competing for the same box office revenue. In the long term, a lean and mean company is one that produces fewer films but with greater average revenue per film than in a more congested movie industry.

The fact that Skydance Animation and Nickelodeon will now be a part of Paramount and Skydance is a positive development right now. After the transaction closes, former NBCUniversal CEO Jeff Shell—who will take over as president of Paramount—told investors on Monday that “we’re going to immediately be a leader in animation.”

read more: Philip Morris suspends nationwide Zyn.com sales in response to a D.C. subpoena.

During the investor call, he said, “Animation is so important from a theatrical perspective and Paramount is very strong with Nickelodeon.”

This summer has witnessed good box office sales for animated films. The worldwide box office receipts for Disney and Pixar’s “Inside Out 2” have topped $1.2 billion in the last month, making it the fifth-highest earnings for an animated film ever. It has the third-highest domestic box office total for an animated movie, with $533.8 million.

“Despicable Me 4,” a joint venture between Universal and Illumination, made $122 million in its five-day domestic premiere during the Fourth of July long weekend.

“More movie options will be available for movie fans today and for generations of new fans in the years ahead if Paramount recognizes the unique place of theaters in communities across this country and around the world,” NATO’s O’Leary said. “We are eager to learn more about this proposal and collaborate with all relevant stakeholders to realize the vital objective of showcasing more films on the big screen.”