Last week, investors moved away from tech stocks and toward smaller companies, which put pressure on the sector and caused the S&P 500 to drop by about 2%.

Following the largest weekly drop for the index since April, tech shares rebounded on Monday, helping the S&P 500 record its best day since June 5.

The Nasdaq Composite finished the day up 1.58% to end at 18,007.57, while the benchmark increased 1.08% to conclude at 5,564.41 and record its best day since June 5. The Dow Jones Industrial Average ended at 40,415.44, up 127.91 points, or 0.32%.

Nvidia surged 4.8%, regaining a portion of its 8% decline from the previous week. More than 2% was also gained by several significant tech equities, including Alphabet and Meta Platforms. The S&P 500’s poorest performance was CrowdStrike, which lost 13.5% and added to its almost 18% loss from the previous week.

Mona Mahajan, a senior financial strategist at Edward Jones, said, “We’re seeing a rotation back into the technology sector after a pretty meaningful sell-off, exacerbated by the CrowdStrike meltdown.” “Investors are feeling more optimistic as a result of the Fed lowering interest rates and earnings broadening.”

The S&P 500 fell by about 2% last week as investors shifted away from tech companies and into smaller names. Tech firms were particularly hard hit during this period. Over 3% of the Nasdaq fell at that time.

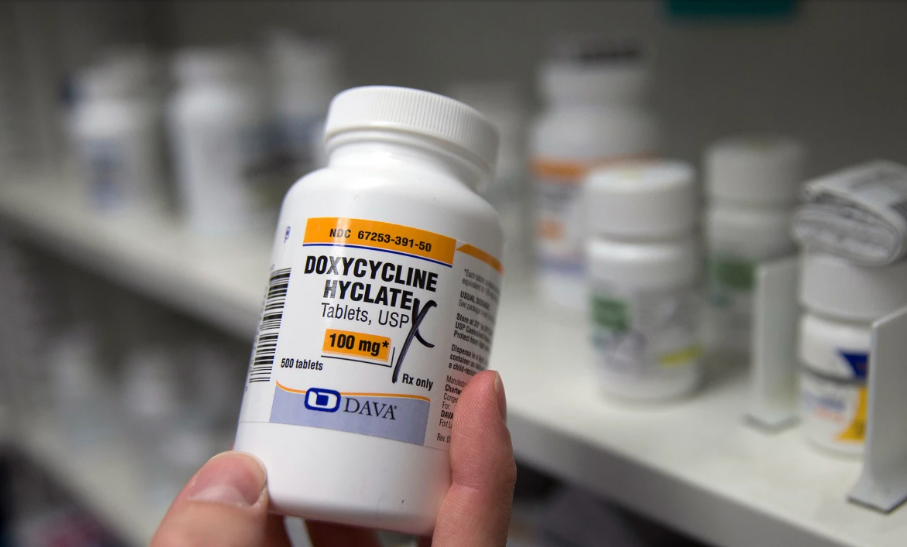

Also Read : Experts claim that the STI pandemic may be reduced with the use of preventive antibiotics.

Small-cap stocks stayed up despite the robust increases in technology. On Monday, the Russell 2000 ended the day 1.7% higher.

Following President Joe Biden’s withdrawal from the presidential contest on Sunday and his endorsement of Vice President Kamala Harris, traders also maintained a watch on the political climate in the United States. Following Joe Biden’s appalling performance in the June debate, many commentators began to predict that former President Donald Trump would win in November.

Wall Street’s primary concerns are still earnings and central bank policy. The probability that the Federal Reserve would lower interest rates at its meeting in September has been factored in by traders by about 93%.