When the Federal Reserve suggested a slower pace of interest rate cuts for 2025 than initially anticipated, major market indexes fell sharply on Wednesday, rekindling fears about how quickly inflation will decline.

As markets closed for the day, losses were more severe, with the S&P 500 losing 2.4% and the Nasdaq Composite losing almost 3%.

The Dow Jones Industrial Average saw its worst drop since August, plunging more than 1,100 points. The Dow is getting closer to having its worst losing run in half a century after its tenth straight day of fall. Despite being striking, the trend mostly shows that investors are shifting their focus from more established businesses to tech firms, which the Dow tends to give less weight to.

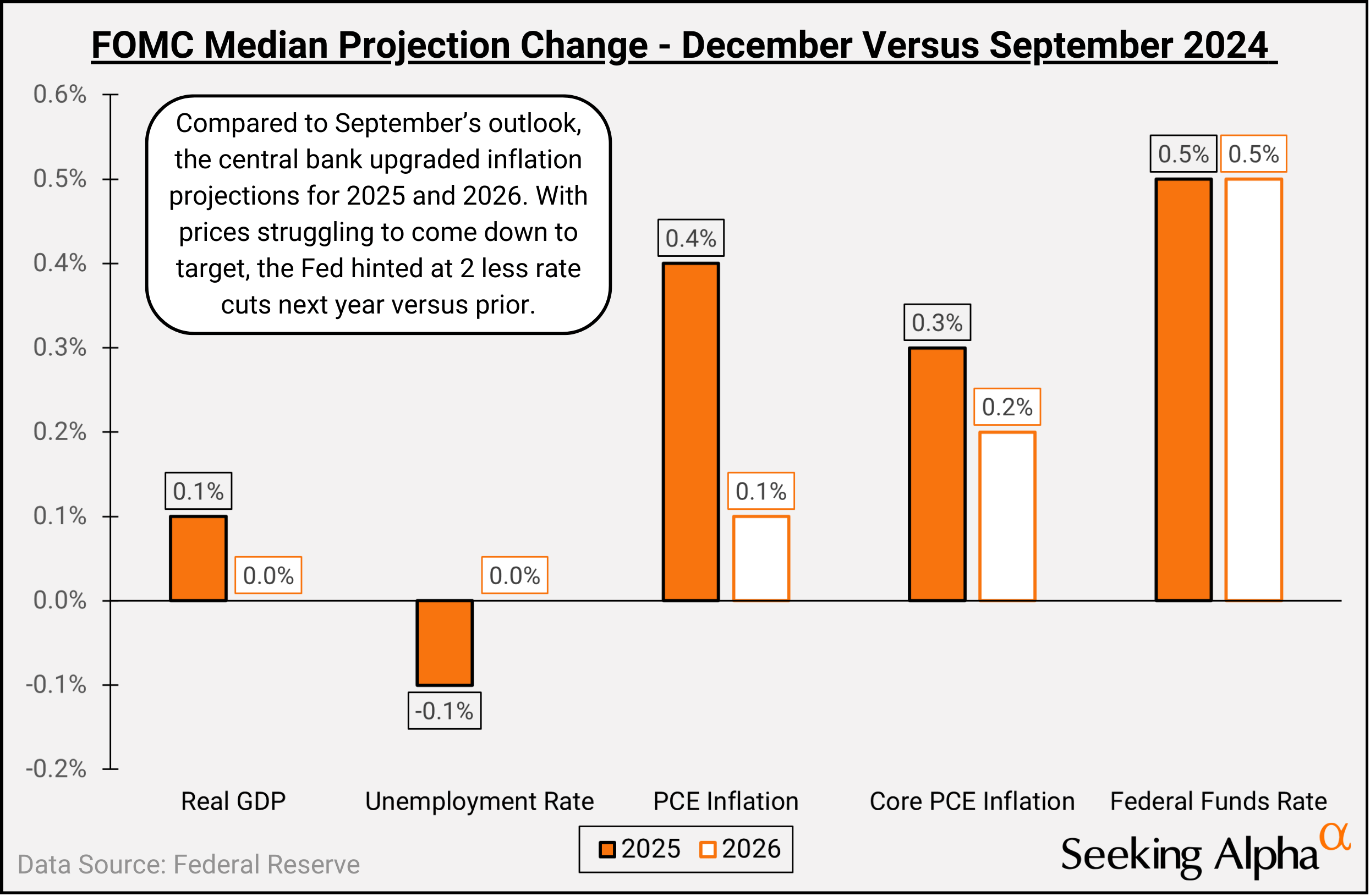

The Federal Reserve said it now expects only two rate cuts in the upcoming year, compared to four months earlier. The central bank now anticipates that inflation will stay over its 2% goal through 2026.

Stated differently, the Fed is indicating that in order to control the rate of price rises, interest rates will need to stay high for a longer period of time.

The outlook for the whole economy is more muddled, but it’s terrible news for equities, whose growth usually benefits from lower interest rates. In addition to raising its forecasts for inflation, the Fed said the job market would likely stay reasonably steady and that the unemployment rate would not likely rise much over its current 4.2% level.

In a commentary sent to clients via email on Wednesday, Charlie Ripley, senior investment strategist at Allianz Investment Management, stated, “The Fed seems more at ease with the direction of the U.S. economy compared to a few months ago and tells us the concerns about inflation are back in play for the Fed.”

Donald Trump continues to be the wild card. According to experts, the president-elect has pledged to impose a wide variety of tariffs, which would probably result in price hikes. In an interview with NBC News, Trump said that he couldn’t promise that if they are put into effect, customers won’t pay more.

Trump has provided a variety of justifications for enforcing the charges, ranging from national security concerns to job creation and revenue generating, but he has not provided a clear picture of how they will eventually affect the economy over the long term.

The outlook for the U.S. economy during Trump’s second term is likewise still uncertain. He has pledged to lower taxes, which would spur growth but would increase the existing debt, even as he vows to cut expenditure at previously unheard-of amounts.

It’s a confusing mixture for monetary authorities and economists, but it suggests that the economy will probably keep becoming hotter.

Seema Shah, chief global strategist at Principal Asset Management, stated in an emailed post on Wednesday that “the economic and inflation backdrop is not one that screams a need for meaningful policy stimulus, while the incoming administration may give them a severe inflation headache next year.”