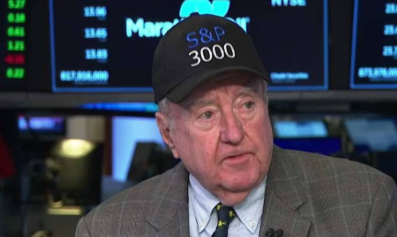

The Washington Post referred to Art Cashin as “Wall Street’s version of Walter Cronkite,” and he was the director of floor operations for UBS at the New York Stock Exchange. Cashin passed away. He had been a regular on CNBC for almost 25 years and was 83 years old.

Cashin was one of the rarest of animals in the fiercely competitive and sometimes violent world of stock market commentary: a man who was revered by both liberals and conservatives, bulls and bears. It appeared that he had very few opponents.

He gathered a group of people who shared his interests every day after trading stopped for decades. They were known as the “Friends of Fermentation” and met at Bobby Van’s Steakhouse across the street and the bar of the NYSE luncheon club. He always had Dewar’s drink on the rocks.

A mix of charm, humor, intellect, and a resolute refusal to embrace many of the contemporary world’s comforts were responsible for Cashin’s success. He was connected to a NYSE custom. He led the singing of the hymn “Wait ‘Till the Sun Shines, Nellie,” which was written in 1905, on Christmas Eve and New Year’s Eve every year.

Cashin claimed to value his privacy and refused to use credit cards, paying with cash for everything, including his large bar bills. His notes were handwritten and emailed to his helper; he never learned how to use a computer. He hardly ever answered his antiquated flip phone for years.

The documents he had gathered over the decades were heaped high on his desk. Sometimes it looked like a recycling center. Cashin’s ties were constantly out of style, and his clothes were always rumpled.

But his demeanor was not random, nor was his look. It was a component of a persona that had been meticulously crafted on Wall Street over more than half a century.

The year 1941 saw the birth of Arthur D. Cashin Jr. in Jersey City, New Jersey. His parents oversaw an apartment complex as superintendents. When he was just 17 years old and still in high school, he started working in business in 1959 at Thomson McKinnon, a brokerage firm. When Cashin’s father passed away suddenly that year, he was forced to enter the workforce.

At the age of 23, he joined the NYSE and joined P.R. Herzig & Co. as a partner in 1964.

The NYSE floor was where the great bulk of all trading at the time took place. The cacophony of thousands of traders yelling at one another is central to Cashin’s first recollections. He asserted that because sellers sounded frantic, he could tell if the market was rising or falling based on the volume of the yelling.

I would thus know that the vendors were approaching me if the sounds had a high pitch. In a 2018 interview, he stated, “Or if it was a rumble, I would know that it was probably buyers coming.”

Disgusted by the corruption in Jersey City, his birthplace, Cashin entered a mayoral campaign in the middle of the 1970s. “I believe I placed 12th out of five runners,” he remarked. “But there wasn’t much chance I was going to get elected once they found out I was honest.”

He went back to work on Wall Street. He began managing PaineWebber’s floor business in 1980 and remained in that role until UBS acquired the company in 2000.Then 2001 arrived.

After terrorists slammed two jetliners into the World Trade capital buildings on September 11, 2001, killing over 2,600 people in the country’s financial capital, Cashin would frequently remember what it was like to flee Ground Zero.

Thirteen days later, he said in a remark, “Many of us got out that Tuesday walking through streets onto which ash, smoke, and business envelopes fell snow-like, blocking both your view and your breathing.”

However, strangers were welcomed into the caravan and given a spare moist cloth to breathe through while walking, which was kept in their pockets. There was a volunteer fleet of tugboats, fishing boats, and mini-ferries that resembled the Dunkirk evacuation when we arrived at the East River (Brooklyn side of Manhattan). No fee. No cash. Simply — “May I assist you!” Nobody was given a name.

Thank-you notes will not be issued. However, Americans, even those in New York, who gladly donate to strangers but quarrel with neighbors, all of a sudden became one group. We all internalize the survivor’s dilemma in the days that follow as we return to Wall Street in new and peculiar ways. We are fortunate to be here, but why us?

Cashin headed the NYSE “Fallen Heroes Fund” following the Sept. 11 attacks, which gave millions of dollars to the families of first responders who were slain while performing their duties.

He was a well-known stock market storyteller, but he was also a recognized market historian. Although he was a careful watcher of both technical and fundamental trading patterns, he never allowed statistics to overshadow his folkloric explanations of the market, which even casual spectators could understand.

He frequently described Wall Street as a collection of individuals with a wide range of viewpoints. As if it were all a John Wayne Western, the bulls and bears would battle it out every day in his world: “The bulls are circling the wagons, trying to defend the highs” was a regular theme.

For almost 40 years, his daily market analysis, Cashin’s Comments, was regularly sent to customers and read by many on Wall Street. After a brief history lesson, it always started with an analysis of a significant event that happened on that date (“On this date in 1918, the worldwide flu epidemic went into high gear in the U.S.”).

Then, it connected that event to the events that took place in the markets that day (“On Wednesday morning before the opening of the markets, U.S. stock futures looked like they might be coming down with the flu.”). Some of the outlooks were hazy, and a few of earnings reports weren’t very positive.

Long before the term was created, he was a behavioral psychologist and a great observer of human behavior. He had witnessed several instances of human panic and the consequences of giving in to the first impulse to sell without hesitation.

“It indicates to me that people tend to overreact and not give things enough thought,” he added. And once more, you divide people into two groups: those who see events suspiciously and those who say, ‘Oh, I have to respond to that.’ Those who respond right away seldom succeed. Those that are a little skeptical perform far better.

His family and the New York Stock Exchange were his two greatest passions. The legendary NYSE trading floor still exists in the era of automated trading, but in a much reduced capacity. He stated he was “disappointed… but it was understandable” when it was shut down during the Covid epidemic.

When asked about the emergence of computerized trading, which has gradually diminished that floor’s power, Cashin responded in a philosophical manner. He once said at Bobby Van’s, “I miss those magnificent days when your spirit hung on the fact that you were good for your word or you’re outta here,” although he acknowledged that electronic trading had increased trade speed and accuracy, especially in recordkeeping.

Perhaps his modesty will be his most memorable quality among his many friends. He appeared to be truly perplexed by his fame. Arthur Cashin is something that people are interested in. I’m not really sure why,” he said.

He also joked, “I think I owe an apology to Walter Cronkite,” in response to The Washington Post’s lengthy feature of his career in 2019 that referred to him as Wall Street’s equivalent of CBS newsman Cronkite.