As the venerable American chipmaker has found it difficult to stay up with the artificial intelligence revolution, Intel’s CEO is resigning.

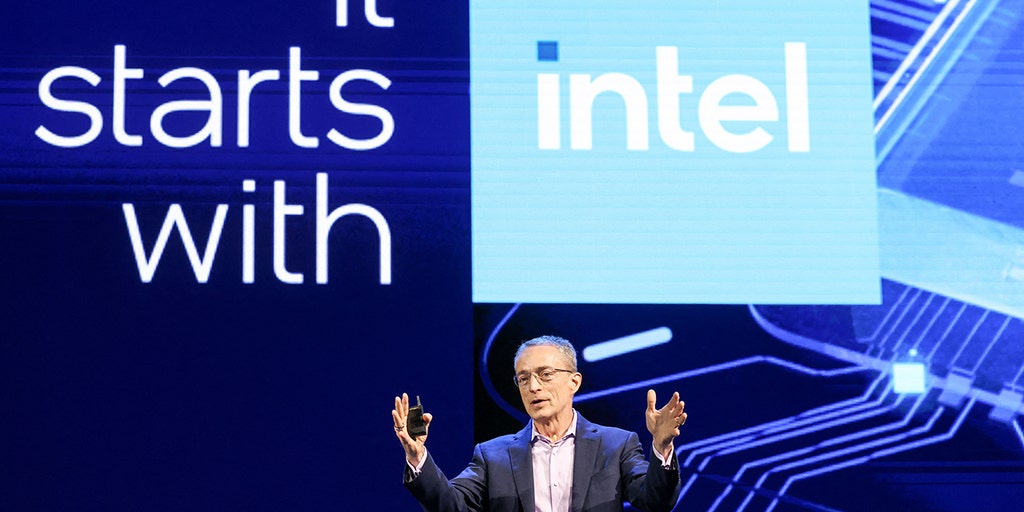

With effect from Sunday, the firm stated that Pat Gelsinger, who had been the leader of Intel since 2021 and had served in a variety of capacities for the chipmaker for more than 30 years, had retired.

In a news release, Intel’s board chair Frank Yeary stated, “We know that we have much more work to do at the company and are committed to restoring investor confidence, even though we have made significant progress in regaining manufacturing competitiveness and building the capabilities to be a world-class foundry.”

Over the past few years, Intel, the industry leader in computer chip manufacture in the United States, has found it difficult to keep up with the shift toward artificial intelligence. Intel could not afford to make the same mistake again by failing to predict the next big tech trend after missing out on the smartphone boom of the 2010s.

However, it has mostly fallen short of expectations, with terrible results. Major IT companies started turning to rival chipmaker Nvidia to meet much of their AI computer processing demands as the AI boom got underway in 2022.

This is because the demanding computational power requirements of AI processes are better met by Nvidia’s graphics processing unit (GPU) processors.

Because of their “parallel processing ability,” Nvidia’s GPUs can do computations more quickly, whereas standard CPUs, the type of processors in which Intel has historically specialized, are better suited for simple computational activities like copying information to a disk.

The result has been an almost endless demand for Nvidia’s CPUs. Since Gelsinger came onboard, Nvidia’s stock has increased by more than 820%, while Intel’s has decreased by 61%.

During that period, the S&P 500 increased by 54%. Intel’s market capitalization is under $100 billion, which is around 30 times less than Nvidia’s current valuation of over $3 trillion.

According to Intel’s most recent financial report, which stated that the business was undergoing its most significant reorganization since its founding in 1968, Gelsinger had started a push to improve the company’s fortunes.

Although the Biden administration has looked to use CHIPS Act cash to assist Intel, it revealed last month that it was cutting the size of a planned commitment by $600 million in comparison to the award it had previously made in March.

The Commerce Department pointed out that several projects’ schedules had gone over the government’s 2030 target, but part of that was because Intel had also announced a $3 billion Defense Department deal.