According to the government, businesses may charge different clients varying rates because of this behavior.

In an effort to learn more about how artificial intelligence is used to quickly alter prices based on information about consumer behavior and attributes, the Federal Trade Commission is initiating an inquiry into what is known as “surveillance pricing.”

According to the FTC, this method permits businesses to charge varying rates to different clients.

Eight firms, all of whom the agency claims tout their AI and other tech capabilities together with a wealth of customer data to tailor pricing to specific clients, are being served by the government with a necessary information request.

Accenture, Mastercard, JPMorgan Chase, and consultancy behemoth McKinsey all on the list. It also includes software company Task, which serves grocery chains Hannaford, Home Depot, and Starbucks; Revionics, which services FreshDirect, Total Wine, and Puma; and Pros, which was recognized as Microsoft’s internet service vendor of the year this year.

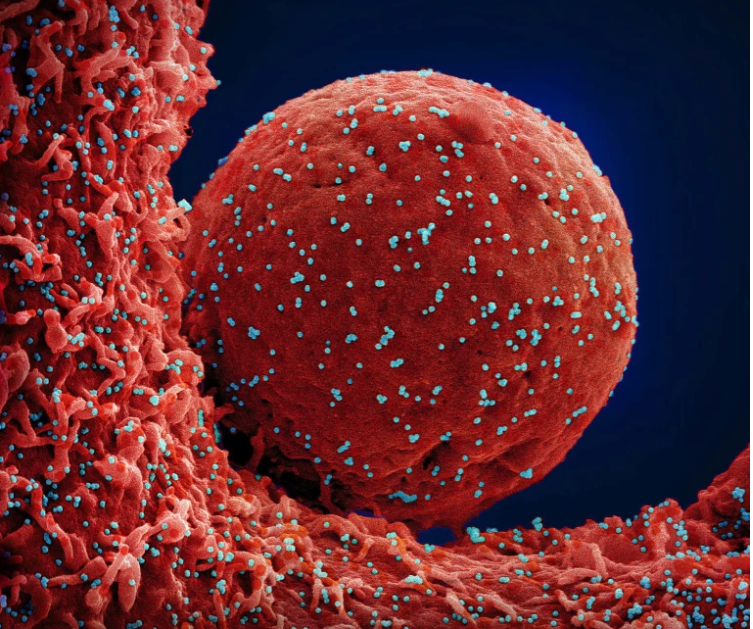

Also Read : Extended COVID lung injury and immune system reaction

According to a press release, FTC Chair Lina Khan said, “Companies that harvest Americans’ personal data can put people’s privacy at risk.” “Now, businesses might be charging consumers more by taking advantage of this enormous cache of personal data.”

Surveillance pricing, according to Kahn, is a “shadowy ecosystem of pricing middlemen.”

The FTC is requesting information regarding the kinds of goods and services provided, the ways in which the businesses get consumer data, the identities of their clientele, the ways in which the customers use these goods and services, and the effects these offerings have on consumer prices.

Under its 6(b) power, which permits it to gather data for research without requiring a particular law enforcement action, the agency is carrying out this operation.

CNBC has made contact with the businesses included in the FTC’s demands.

In a statement, Mastercard stated, “We will collaborate with the FTC throughout this process.”